Secure Your Family’s Future with Estate Planning

Get 10% off an estate plan through our exclusive partnership with Trust & Will—America’s leading digital estate-planning platform trusted by over one million families.

Why Choose Trust & Will?

- Affordable Services

Members save 10% on any estate plan and receive first shipment of documents at no extra cost. - Expert Support

Attorney-approved, state-specific documents built by legal experts—and a dedicated support team ready to answer your questions. - Easy & Convenient

Guided, step-by-step process lets you complete your will or trust online in as little as 20 minutes. - Built for You

Customizable, legally valid documents tailored to your state’s requirements.

Which Plan Is Right for You?

| Plan | Retail Price | Your Price* | Key Features | Action |

|---|---|---|---|---|

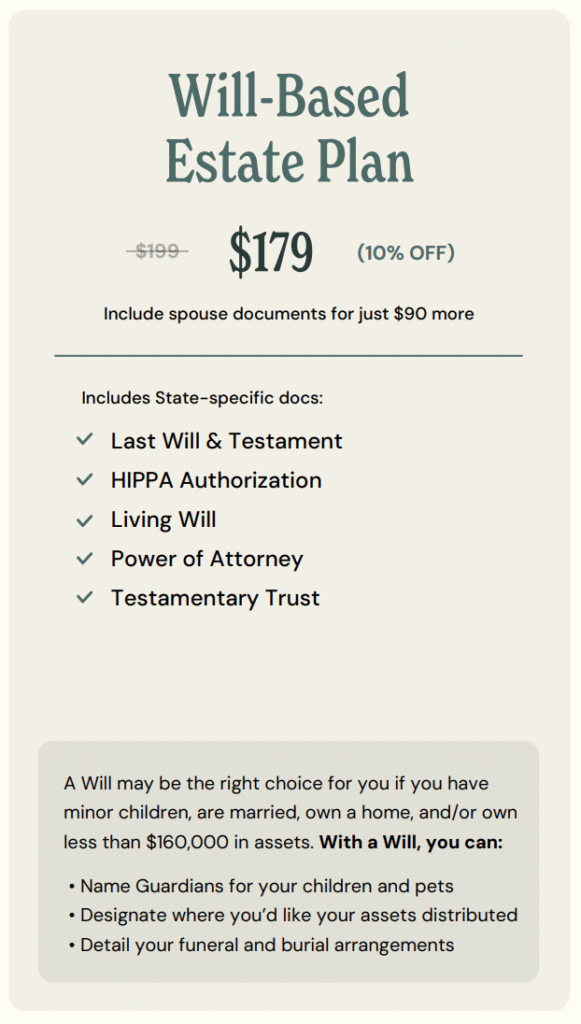

| Will-Based Estate Plan | –10% = $179* | – Name guardians for children & pets – Specify asset distribution – Appoint health-care agents | Create Your Will | |

| Trust-Based Estate Plan | –10% = $449* | – All will benefits plus + – Revocable living trust – Asset-distribution conditions – Probate avoidance | Create Your Trust |

*After your exclusive discount.

Will vs. Trust: Understanding the Difference

| Feature | Will | Trust |

|---|---|---|

| Effective Date | Upon passing away | Immediately when signed & funded |

| Probate | Must go through probate (public court) | Avoids probate—keeps assets private |

| Incapacity Plan | No (requires court-appointed conservator) | Yes (successor trustee steps in seamlessly) |

| Privacy | Public record | Private |

| Control & Flexibility | Limited after death | Ongoing control during life & after death |

| Naming Guardians | Yes (for minors & pets) | No (handled via separate document, but you can specify) |

Which Do I Need?

- Simple estates or young families may start with a Will to name guardians and outline basic asset distribution.

- Larger or more complex estates, or those seeking to avoid probate and ensure continuity during incapacity, often benefit from adding a Trust to their plan.

For personalized guidance, our Trust & Will experts are just a click away.

Frequently Asked Questions

Q1: What happens if I die without a will?

A: Without a will, state “intestacy” laws determine distribution—often not aligned with your wishes—and courts appoint guardians for minor children.

Q2: Is an online estate plan legally valid?

A: Yes. Trust & Will’s documents are attorney-approved and follow state-specific legal requirements for validity.

Q3: How long does it take to complete my plan?

A: Most users finish within 30 minutes with our guided process—no appointments needed.

Q4: Can I update my will or trust after creating it?

A: Absolutely. Wills can be amended with a codicil, and revocable trusts can be updated by moving assets in/out or executing a trust amendment.

Q5: Do I need a lawyer?

A: Our platform is built by estate-planning attorneys. If you need additional legal advice, you can consult your own attorney, but no lawyer visit is required to create valid documents.

Get Started with Your Estate Plan

Peterman Insurance Services is proud to partner with Trust & Will to bring you this exclusive offer!